Shareholder Proposal Developments During The 2025 Proxy Season

This post provides an overview of shareholder proposals submitted to public companies during the 2025 proxy season, including statistics and notable decisions from the staff (the “Staff”) of the Securities and Exchange Commission (the “SEC”) on no-action requests. As discussed below, based on the results of the 2025 proxy season, there are several key takeaways to consider for the coming year:

- Shareholder proposal submissions fell for the first time since 2020.

- The number of proposals decreased across all categories (social, governance, environmental, civic engagement and executive compensation).

- No-action request volumes continued to rise and outcomes continued to revert to pre-2022 norms, with the number of no-action requests increasing significantly and success rates holding steady with 2024.

- Anti-ESG proposals continued to proliferate in 2025, but shareholder support remained low.

- Data from the 2025 season suggests that the Staff’s responses to arguments challenging politicized proposals (those proposals that express either critical or supportive views on ESG, DEI and other topics) were driven by the specific terms of the proposals and not by political perspectives.

- New Staff guidance marked a more traditional application of Rule 14a-8, but the results of the 2025 season indicate that Staff Legal Bulletin 14M (“SLB 14M”) did not provide companies with a blank check to exclude proposals under the economic relevance, ordinary business or micromanagement exceptions.

Overview of Shareholder Proposals Submitted

- Social Proposals: The largest subcategory of social proposals was nondiscrimination and diversity-related proposals, representing 45% of all social proposals, with 112 submitted in 2025, as compared to 97 in 2024. Of note, anti-ESG proposals made up 58% of nondiscrimination and diversity-related proposals (compared to 44% in 2024).

- Governance Proposals: Special meeting rights proposals replaced simple majority vote proposals as the most common governance proposal, representing 34% of these proposals, with 76 submitted, up from 29 proposals in 2024.

- Environmental Proposals: The largest subcategory of environmental proposals, representing 54% of these proposals, continued to be climate change proposals, with 80 submitted in 2025 (down substantially from 126 in 2024 and 150 in 2023).

- Civic Engagement Proposals: Lobbying spending proposals were up slightly, with 37 in 2025 and 35 in 2024. Political contributions proposals were down to 21 in 2025, as compared to 30 proposals in 2024. The number of political spending congruence proposals fell to 2 from 13 in 2024.

- Executive Compensation Proposals: The largest subcategory of executive compensation proposals continued to be those requesting that boards seek shareholder approval of certain severance agreements, representing 50% of these proposals, up from 44% in 2024.

Most Popular Shareholder Proposals Submitted to Public Companies

- Three of the five most popular proposal topics during the 2025 proxy season were the same as those in the 2024 proxy season.

- The concentration of the top five most popular topics rose slightly from 39% of proposals submitted in 2024 to 43% of proposals submitted in 2025.

- This level of concentration is still below that of the 2022 and 2023 proxy seasons,* as proponents continue to submit proposals across a broad spectrum of topics.

*The concentration of the top five most popular topics was 49% in 2022 and 45% in 2023.

Overview of Shareholder Proposal Outcomes

The 2025 proxy season saw both new and continued trends in proposal outcomes that emerged in the 2024 proxy season:

- the percentage of proposals voted on decreased (55% in 2025 compared to 63% in 2024);

- overall support increased slightly (23.1% in 2025 compared to 22.9% in 2024);

- the percentage of proposals excluded through a no-action request increased substantially (25% in 2025 compared to 15% in 2024); and

- the percentage of proposals withdrawn decreased slightly (13% in 2025 compared to 15% in 2024).

*Statistics on proposal outcomes exclude proposals that the ISS database reported as having been submitted but that were not in the proxy or were not voted on for other reasons (e.g., due to a proposal being withdrawn but not publicized as such or the failure of the proponent to present the proposal at the meeting). Outcomes also exclude proposals that were to be voted on after July 1. As a result, in each year, percentages may not add up to 100%. ISS reported that 21 proposals (representing 3% of the proposals submitted during the 2025 proxy season) remained pending as of July 1, 2025, and 16 proposals (representing 2% of the proposals submitted during the 2024 proxy season) remained pending as of July 1, 2024.

Voting Results

- Shareholder proposals voted on during the 2025 proxy season averaged support of 23.1%, slightly higher than the average support of 22.9% in 2024.

- Notably, consistent with 2024, average support was depressed in part due to the voting results for anti-ESG proposals, which received average support of 1.4%.

- Excluding the 60 anti-ESG proposals that were voted on, average support for shareholder proposals during the 2025 proxy season was 26.6%.

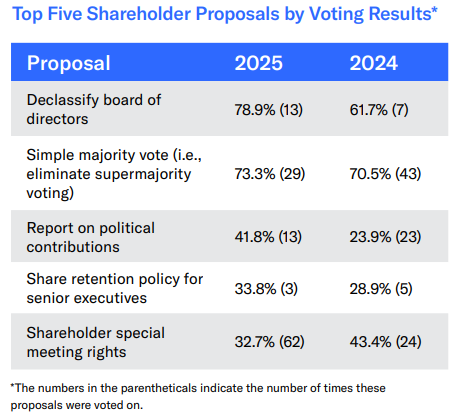

Top Five Shareholder Proposals by Voting Results

The table to the right shows the five shareholder proposal topics voted on at least three times that received the highest average support in 2025. x Compared to 2024, proposals requesting a report on political contributions and a share retention policy for senior executives were new to the top five list for 2025.

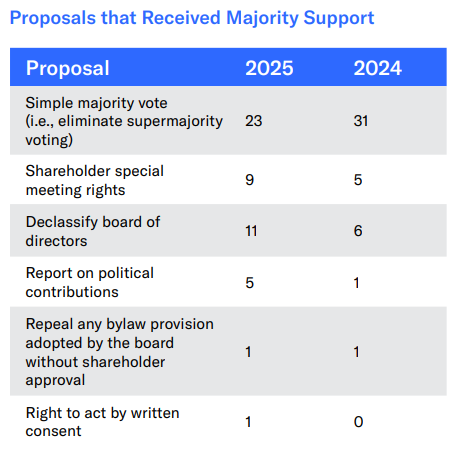

Majority-Supported Proposals

- As of July 1, 2025, 50 proposals (6% of the proposals submitted and 11% of the proposals voted on) received majority support, as compared with 48 proposals (5% of the proposals submitted and 8% of the proposals voted on) that had received majority support as of July 1, 2024.

- Governance proposals have consistently ranked among the highest number of majority-supported proposals, and in 2025 they accounted for 88% of these proposals (compared to 92% in 2024).

- No environmental, social or executive compensation proposals received majority support in 2025, compared to two environmental proposals receiving majority support and zero social or executive compensation proposals receiving majority support in 2024. This is a significant change from 2023 when environmental and social proposals together represented 24% of majority-supported proposals and 8% related to executive compensation (as of June 1, 2023).

Shareholder Proposal No-Action Requests Summary

- Continuing the trend from the 2024 proxy season, the number of no-action requests rose significantly again during the 2025 proxy season, up 41% compared to 2024.

- The Staff granted approximately 69% of decided no-action requests in 2025, signaling a continued trend of returning to the higher success rates in 2021 and 2020 (71% and 70%, respectively).

- Withdrawal rates remained relatively steady with 2024 despite the higher submission rate in 2025.

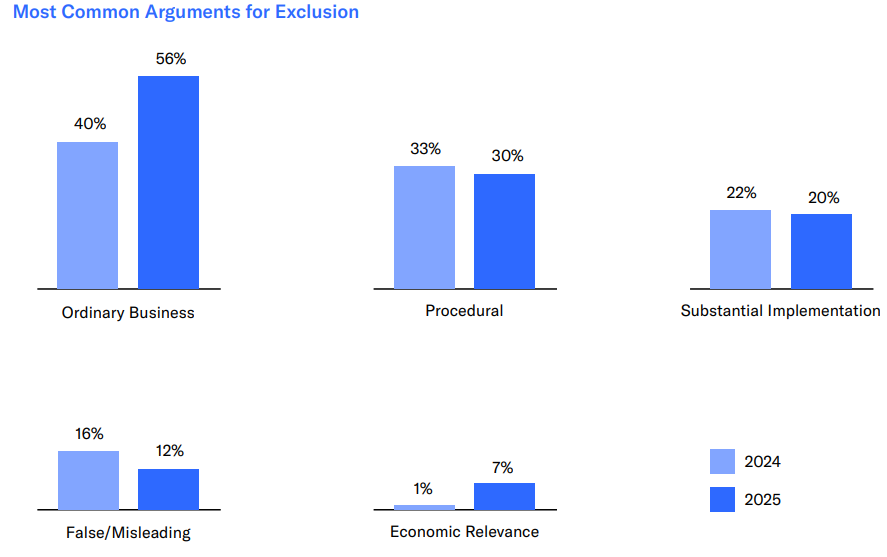

Most Common No-Action Request Arguments

- Consistent with 2024, ordinary business and substantial implementation were the most argued substantive grounds for exclusion in the 2025 proxy season.

- In fact, the top four most common arguments for exclusion were the same in 2024 and 2025.

- Ordinary Business: Rule 14a-8(i)(7): Proposals relating to the company’s ordinary business and that micromanage the company

- Procedural: Procedural arguments include defects related to share ownership, number of proposals, proposal word limit, missed deadlines, statements regarding availability to meet, written documentation for proposal by proxy, procedural and eligibility deficiencies and attendance at meetings

- Substantial Implementation: Rule 14a-8(i)(10): If the company has already substantially implemented the proposal

- False/Misleading: Rule 14a-8(i)(3): Proposals or supporting statements that are contrary to any of the Commission’s proxy rules, including Rule 14a-9, which prohibits materially false or misleading statements in proxy soliciting materials

- Economic Relevance: Rule 14a-8(i)(5): Proposals relating to operations which account for less than 5 percent of the company’s total assets at the end of its most recent fiscal year, and for less than 5 percent of its net earnings and gross sales for its most recent fiscal year, and is not otherwise significantly related to the company’s business

No-Action Request Success Rates and Top Proposals Challenged in 2025

SLB 14M

- On February 12, 2025, the Staff issued guidance in SLB 14M, reinstating standards based on Commission statements that preceded Staff Legal Bulletin 14L (“SLB 14L”) (issued in November 2021).

- SLB 14M marked a return to a more traditional administration of the shareholder proposal rule. Among its top impacts were:

- Reinvigorating the Rule 14a-8(i)(5) “economic relevance” exclusion

- Realigning the Staff’s approach to the Rule 14a-8(i)(7) “ordinary business” exclusion

- Reaffirming the application of the Rule 14a-8(i)(7) “micromanagement” exclusion

- In SLB 14M, the Staff stated that companies could submit new no-action requests or supplement existing no-action requests after their deadlines to address the SLB 14M guidance. As a result:

- Twenty-seven substantive no-action requests were submitted under SLB 14M after the company’s original no-action request deadline with “good cause”.

- Twenty-nine supplemental letters advancing SLB 14M arguments were submitted following the publication of SLB 14M in connection with pending no-action requests.

- Although SLB 14M was viewed by some as more companyfriendly, it did not provide companies with a “blank check” to exclude proposals under the economic relevance or ordinary business and micromanagement exclusions. No-action requests decided following SLB 14M had the following success rates:

- Ordinary business: 57%

- Micromanagement: 52%

- Economic relevance: 31%

Resurgence of Successful Micromanagement Arguments

Micromanagement Arguments

- In the wake of SLB 14L, the submission rate and success rate for micromanagement no-action requests declined significantly.

- In 2024, the submission rate and success rate for micromanagement arguments recovered significantly, with companies submitting 64 no-action requests that argued micromanagement (up from 41 in 2023) with a success rate of 66%, more than double the 31% success rate in 2023, driven in part by increasingly prescriptive proposals.

- Companies increasingly argued micromanagement in the 2025 proxy season, with companies submitting 158 no-action requests arguing micromanagement, up 147% from 2024, and up 285% from 2023. Notably, success rates for micromanagement arguments declined to 51% in 2025, likely due in part to companies advancing more micromanagement arguments in response to the high success rate in 2024.

Lobbying Shareholder Proposals

- This success is best reflected in the Air Products and Chemicals, Inc. letter, where the company successfully excluded on micromanagement grounds a proposal requesting an extensive and detailed report on the company’s lobbying practices.

- Notably, prior to the Air Products decision, lobbying proposals, (one of the most common civic engagement shareholder proposals of the last decade), had not been successfully excluded on micromanagement grounds.

- Following the Air Products decision, 25 companies sought the exclusion of similar traditional lobbying proposals on micromanagement grounds, with 17 of these proposals successfully excluded on micromanagement grounds and the remaining eight proposals withdrawn.

No-Action Requests Challenging Politicized Proposals

- In 2025, 105 pro-ESG proposals were challenged via no-action requests, and 73 anti-ESG proposals were challenged via no-action requests. The charts below reflect the most common topics of these politicized proposals and their no-action request outcomes.

- Consistent with overall results, ordinary business (including both matters relating to the company’s ordinary business and micromanagement arguments) and substantial implementation arguments were the most successful substantive grounds for excluding both proposals reflecting pro- and anti-ESG perspectives.

- Overall, 58% of the no-action requests challenging proposals reflecting anti-ESG perspectives were successful in the 2025 proxy season, as compared to a success rate of 51% for proposals reflecting pro-ESG perspectives.

Link to the full report can be found here.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.