Board Practices and Composition in the Russell 3000 and S&P 500

This report examines how board composition and governance practices evolved in 2025 across US public companies in the Russell 3000 and S&P 500, drawing on longitudinal data from corporate filings and disclosures.

Trusted Insights for What’s Ahead®

- Most boards now operate with eight to 12 directors and three to four committees, balancing effective oversight with agility amid growing regulatory and technological demands.

- Average director age continues to climb as boards favor experience and continuity; this trend strengthens institutional knowledge but may heighten long-term challenges around succession, refreshment, and leadership pipeline development.

- Women now hold about one-third of US board seats—a record high—although momentum has slowed as turnover declines and some boards downplay demographic characteristics.

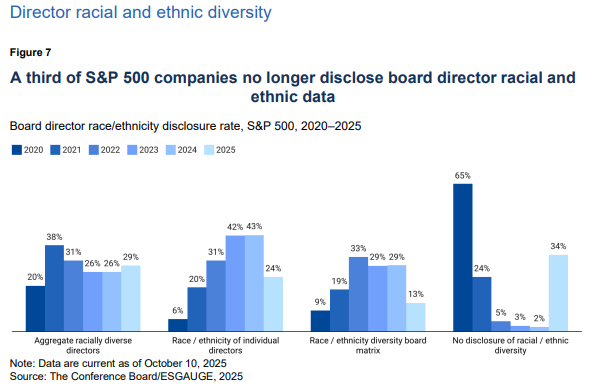

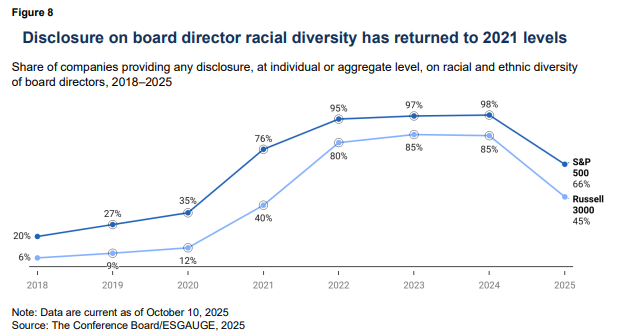

- Board director demographic diversity reporting has contracted sharply, with racial and ethnic disclosure falling from 2024 peaks and complicating year-over-year benchmarking.

- Boards are diversifying beyond traditional CEO backgrounds and adding expertise in technology, cybersecurity, human capital, and sustainability as oversight broadens from financial stewardship to further encompass strategic and risk governance.

- Board turnover and election of new directors slowed in 2025, reflecting both a natural cyclical pause and companies’ tendency to favor stability in uncertain external conditions.

- Board governance is evolving from rigid rules to flexible oversight: term limits remain rare, mandatory retirement ages are relaxing, and overboarding policies are standard but increasingly calibrated to balance capacity, experience, and accountability.

| Corporate board practices and composition encompasses who serves on the board and how the board operates. US public companies disclose information on board size, independence, committees, leadership structure, skills, diversity, and tenure through proxy statements, SEC filings, bylaws, and exchange disclosures to meet regulatory requirements, respond to investor expectations, and demonstrate governance quality. |

Introduction: Corporate Boards in 2025

Corporate boards are operating in an environment defined by heightened scrutiny, rapid technological disruption, and shifting expectations from investors, regulators, and society. The pace of regulatory and political change has accelerated, while macroeconomic and geopolitical volatility continue to test the resilience of US companies and their governance systems.

Amid these pressures, board composition and practices have steadied but continue to shift in measured ways. The 2025 data presented in this report show a landscape defined by continuity more than change: boards are older, more experienced, and increasingly selective in adding new members. Oversight structures are adapting to digital, cybersecurity, and workforce risks, while trends toward demographic diversity and transparency have slowed or, in some cases, stalled. This report helps companies benchmark where they stand in this balance between stability and adaptability and better prepare for emerging trends and practices.

Board Organization

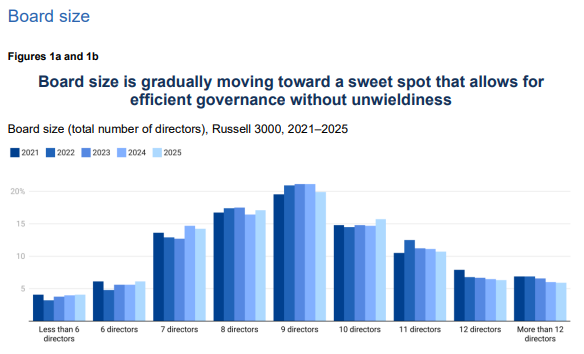

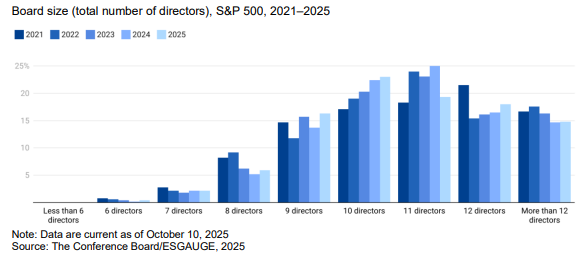

Board size is a long-standing corporate governance preoccupation, as it influences how effectively directors can deliberate, oversee management, and represent shareholder interests. S&P 500 boards continue to be larger on average than those in the Russell 3000, reflecting broader operational complexity, international exposure, and regulatory demands. More than half of all Russell 3000 boards comprise eight to 10 directors, while 10 to 12 directors is typical among S&P 500 firms. Both indexes show a gradual decline at the extremes (fewer than six or more than 12 members), reducing governance risks associated with either limited oversight or unwieldy deliberation.

Sector differences are notable. Financials, utilities, and consumer staples average around 10 directors, consistent with their heavy regulatory and risk oversight burdens. Technology, health care, and real estate boards remain leaner at roughly eight, reflecting smaller company size and more streamlined governance traditions. Industrials, energy, and materials cluster near nine. For smaller and mid-cap companies, maintaining agility while integrating new competencies and emerging technologies such as AI will be a growing challenge. Larger boards, meanwhile, must continue to guard against inefficiency and diluted accountability.

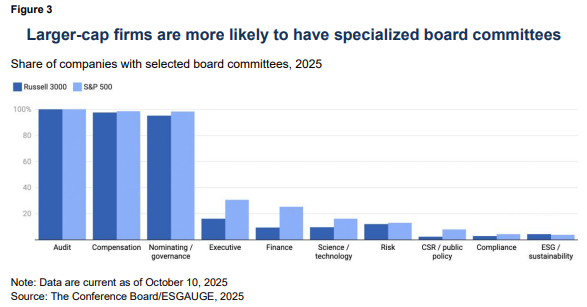

Committees remain the foundation of board governance, enabling targeted oversight and deeper expertise. In 2025, nearly half of Russell 3000 companies operated with three or fewer committees, typically the statutory minimum of audit, compensation, and nominating/ governance. By contrast, S&P 500 companies generally maintain more specialized structures: four committees is the most common (37%), with a notable share at five (22%) or six or more (16%), reflecting the strategic and organizational complexities more common in larger firms.

Utilities and financials tend to be particularly committee heavy—20% in both have six or more committees—reflecting risk and regulatory intensity. Information technology and communication services companies are more streamlined, with roughly 60% operating with three or fewer. Other sectors fall between these.

The three core committees—audit, compensation, and nominating/governance—remain the dominant governance structures. Audit committees are universal, present at 100% of firms in both indexes. Compensation and nominating/governance committees are nearly ubiquitous but not entirely universal, reflecting that Nasdaq allows companies to comply without a dedicated nominating/governance committee and that some issuers meet compensation oversight requirements without maintaining a formally designated compensation committee.

Beyond these big three, specialized committees also continue to evolve.

- Executive committees are still prevalent but trending downward as more decisions move to the full board.

- Finance committees are concentrated in large-cap firms with complex capital structures and treasury operations.

- Risk committees are used selectively, present at nearly half of financial firms (and required for large federal bank holding companies) but modest elsewhere, where risk oversight typically resides with the audit committee.

- Science and technology committees are emerging as boards confront AI, data governance, and R&D oversight.

- ESG/sustainability committees are rare and tend to cluster in energy, materials, and utilities; most other sectors integrate environmental, social & governance issues within the nominating/governance function.

Ultimately, committee architecture should align with each company’s organizational complexity, regulatory exposure, risk profile, and strategic priorities. The data show that most boards have reached a structural equilibrium—lean enough to stay focused but sufficiently differentiated to manage a widening array of oversight responsibilities.

Board Composition

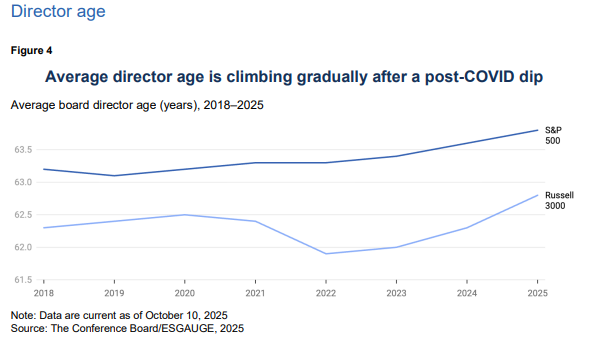

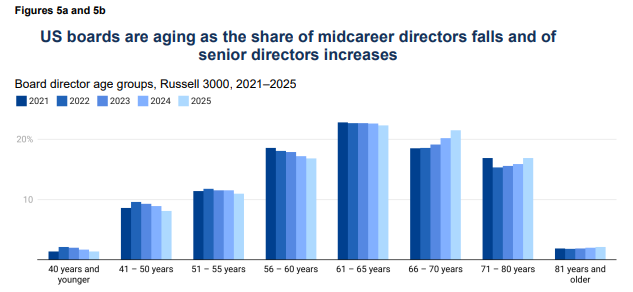

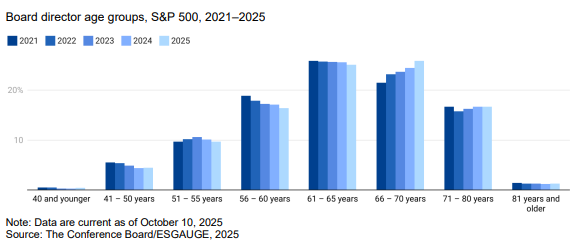

In the Russell 3000, the average director age fell to 61.9 in 2022 but rose to 62.8 by 2025. In the S&P 500, the increase has been steadier—from 63.2 in 2020 to 63.8 in 2025. This gradual upward shift may indicate that boards are more explicitly valuing experience and institutional continuity during a period of heightened geopolitical, regulatory, and market uncertainty. The age distribution of board directors reinforces this supposition.

Directors aged 56–60 now represent only about 1 in 6 board members, down from 1 in 5 in 2020, while those aged 66–70 have grown from 18% to 22% in the Russell 3000 and from 21% to 26% in the S&P 500. The 61–65 cohort remains stable at roughly one-quarter of directors, but the expansion of both the 66–70 and 71–80 brackets has raised overall averages. With the share of directors under 55 stagnant or shrinking, boards may be extending tenure rather than replenishing from midcareer ranks.

While older boards may provide steadier oversight and institutional knowledge, the trend raises potential challenges for succession planning, refreshment cadence, and the development of a diverse pipeline of next-generation board talent.

Gender diversity on US corporate boards has reached historic levels, surpassing the 30% threshold long viewed by investors as a baseline for meaningful representation. Women now hold 30.3% of Russell 3000 and 34.3% of S&P 500 board seats.

Gains were strongest between 2020 and 2023, when investor attention and state legislative action drove an increase in the number of female directors. Since 2023, growth has moderated as vacancies declined and refreshment cycles stabilized. The share of women among newly appointed directors has also fallen from its 2022 peak. In a shifting environment for corporate diversity efforts and goals, some boards may also be prioritizing technical or risk management expertise over demographic diversification.

This slowdown in demographic diversification is occurring alongside a significant tightening of disclosure. In 2024, nearly all companies continued to report data on directors’ racial and ethnic backgrounds, either in aggregate or individually. However, the share doing so fell sharply in 2025—from 98% to 66% among S&P 500 companies and from 86% to 45% among Russell 3000 companies. The reversal followed the 2024 court decision striking down Nasdaq’s board diversity disclosure rule and a broader shift away from public commitments to diversity amid legal and political challenges.

As of October 2025, verified 2025 demographic data were available for roughly 6,500 directors in the Russell 3000 and 1,800 in the S&P 500—down from nearly 19,000 and 3,900 the prior year. This marks a return to 2021 levels of disclosure, after a surge driven by investor pressure, social movements, and emerging regulatory expectations. This contraction in transparency represents one of the most significant governance developments of 2025, raising questions about the sustainability of prior gains in board diversity.

This decline in disclosure complicates year-over-year benchmarking. With far fewer companies reporting—and those that do not necessarily representative of the broader market—apparent shifts in racial and ethnic diversity may reflect reporting bias as much as actual board composition. Within this narrower data set, the share of non-White directors remained broadly stable in 2025: 23.9% in the Russell 3000 and 24.7% in the S&P 500, compared with 23.3% and 25.7% the year before. These figures should be interpreted cautiously, given the smaller and potentially less representative reporting universe.

Board Expertise and Skills Mix

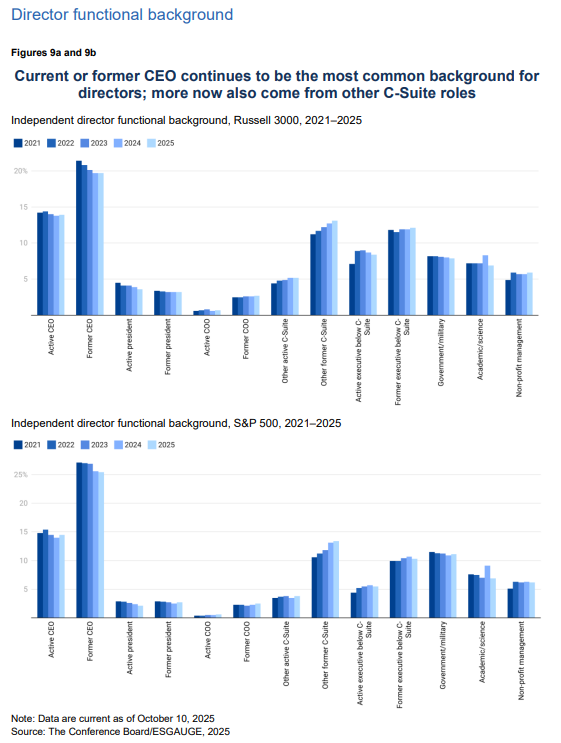

Boards remain dominated by individuals with senior executive experience, although the composition of that experience continues to broaden. Current and former CEOs still account for a large share of independent directors, valued for their broad strategic perspective, decision-making authority, credibility with investors, and ability to coach and mentor other CEOs.

However, CEO representation is gradually declining in the Russell 3000 as boards draw from a wider range of C-Suite and operating leaders. Increasingly, directors bring expertise from roles outside the traditional CEO, chief operating officer (COO), and president track—such as finance, technology, or human capital management—reflecting a more expansive definition of effective oversight.

S&P 500 boards remain more CEO heavy: roughly 1 in 4 directors is a former CEO and about 1 in 7 an active one. These boards are also more likely to include former government or military officials, consistent with their global scale and regulatory exposure.

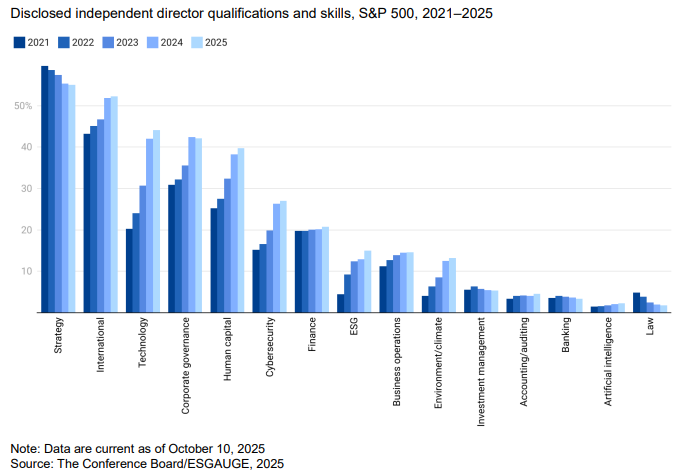

Board disclosures indicate a continued expansion in the range of skills represented among independent directors, particularly in areas tied to emerging risks and long-term competitiveness. While traditional competencies such as finance, law, and strategy remain widespread, newer priorities have gained ground in corporate disclosures since 2021:

- Technology expertise has risen from 15% to 30% of directors in the Russell 3000 and from 20% to 44% in the S&P 500 since 2021, reflecting the centrality of digital transformation, data governance, and AI oversight.

- Cybersecurity experience nearly doubled, now cited by 17% of Russell 3000 directors and 27% of those in the S&P 500, as boards face mounting regulatory and operational expectations around cyber resilience.

- Human capital expertise increased to 28% in the Russell 3000 and 40% in the S&P 500, signaling greater boardroom emphasis on workforce strategy, leadership development, and organizational culture.

- ESG capability, though still less common, has expanded from 2% to 10% in the Russell 3000 and from 5% to 15% in the S&P 500. In practice, “ESG” is not always consistently defined and may reflect broad familiarity with sustainability issues rather than a discrete, technical competency.

- Corporate governance knowledge itself is now listed for roughly one-third of Russell 3000 directors and over 40% of S&P 500 directors—an increase of about 10 points since 2021— reflecting rising expectations for regulatory fluency and stewardship.

- International experience continues to differentiate larger companies, cited for 31% of Russell 3000 directors and 52% of S&P 500 directors, underscoring the need for crossborder risk awareness.

The rise of technology, cybersecurity, human capital, and ESG expertise illustrates that the definition of fiduciary competence is evolving to encompass a more strategic understanding of risk, resilience, and long-term value creation. At the same time, the self-reported nature of board skills matrixes remains a major caveat: these disclosures often signal evolving corporate priorities as much as they reflect verified director capabilities. Even so, the trend points to a more adaptive model of governance, one that aligns board composition with the increasingly complex mix of risks and opportunities companies face in 2025 and beyond.

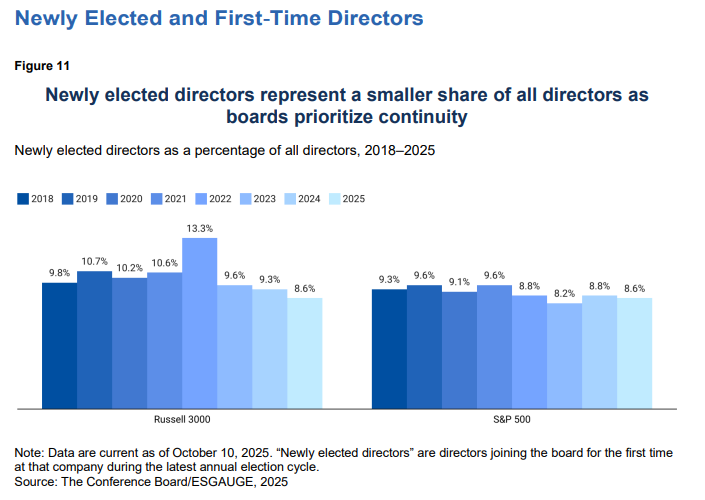

Board turnover noticeably slowed in 2025 as companies prioritized continuity over change. Newly elected directors accounted for just 8.6% of all sitting board members in the Russell 3000—down from a postpandemic peak of 13.3% in 2022 and the lowest level in several years.

The 2022 spike reflected a period of deliberate renewal, when many companies diversified board composition and added skills in digital transformation, human capital management, and ESG oversight. By contrast, the current slowdown suggests boards are integrating those earlier additions, reflecting satisfaction with existing composition or a desire to minimize disruption amid political, regulatory, and market shifts.

The S&P 500 showed a steadier pattern but the same directional decline, with fewer new appointments since the most recent peak in 2021.

More than half of Russell 3000 companies (51%) and 44% of S&P 500 firms made no new board appointments in 2025. Only 18% and 22%, respectively, added more than one new director. While this stability may indicate confidence in existing capabilities, it also raises questions about whether boards are refreshing fast enough to keep pace with today’s accelerated rate of change.

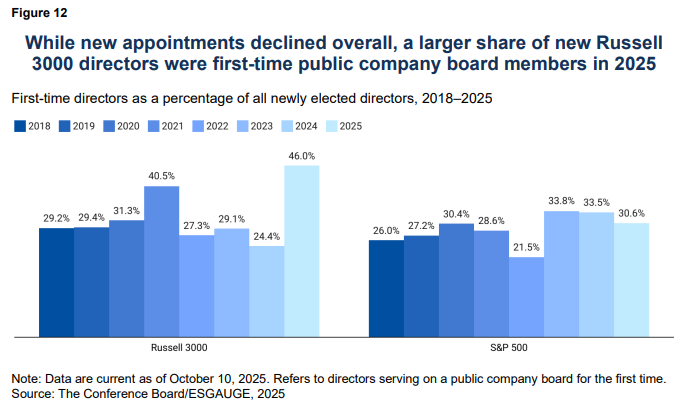

Despite fewer total appointments, the composition of newly elected directors reveals a meaningful shift. In the Russell 3000, 46% of newly elected directors in 2025 were serving on a public company board for the first time—up sharply from prior years. By contrast, the S&P 500 remains more stable, with fewer first-time directors and continued reliance on seasoned board members, reflecting large-cap firms’ preference for proven experience and continuity.

First-time directors are notably younger than other board members—averaging 56.2 years in the Russell 3000 and 55.6 in the S&P 500—and predominantly drawn from senior executive ranks. In the Russell 3000, 27% are active or former C-Suite leaders and another 27% are executives below the C-Suite (31% and 20%, respectively, in the S&P 500). Many report expertise in high-demand areas such as technology, human capital, and international business.

Taken together, these trends point to a governance landscape defined by stability at the top and targeted renewal at the margins. Smaller and mid-cap companies are more open to first-time directors, while larger firms continue to value experience and continuity. The result is a more selective approach to board refreshment—fewer appointments overall, but with sharper focus.

Board Policies and Governance Standards

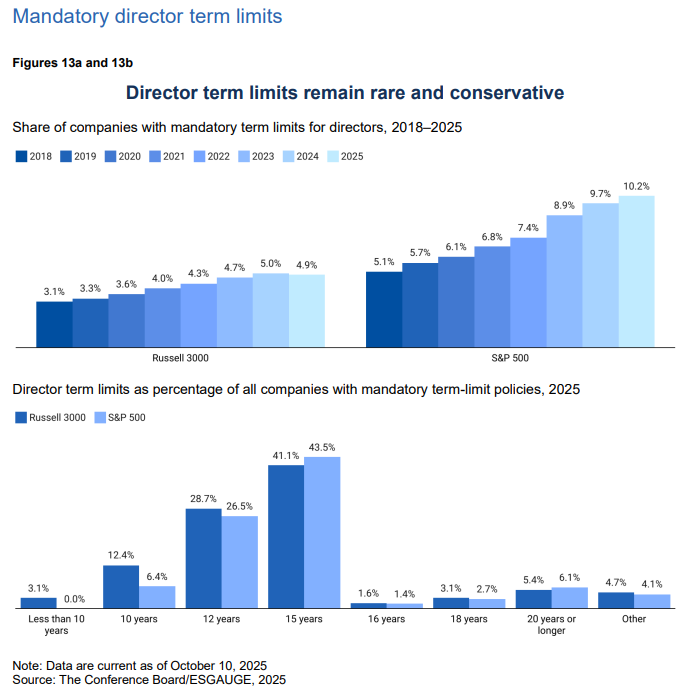

Formal rules that cap the number of years a director may serve remain uncommon among US public companies, though modestly increasing year over year. Where adopted, they typically fall in the range of 12 to 15 years, a horizon that balances renewal with continuity.

Longer limits reflect boards’ desire to preserve institutional knowledge and allow multiple strategic and leadership cycles to unfold before mandatory turnover. The value of these policies may lie less in enforcement than in structure: creating a predictable cadence of board refreshment, strengthening succession planning, and signaling to investors that the board manages renewal proactively rather than reactively.

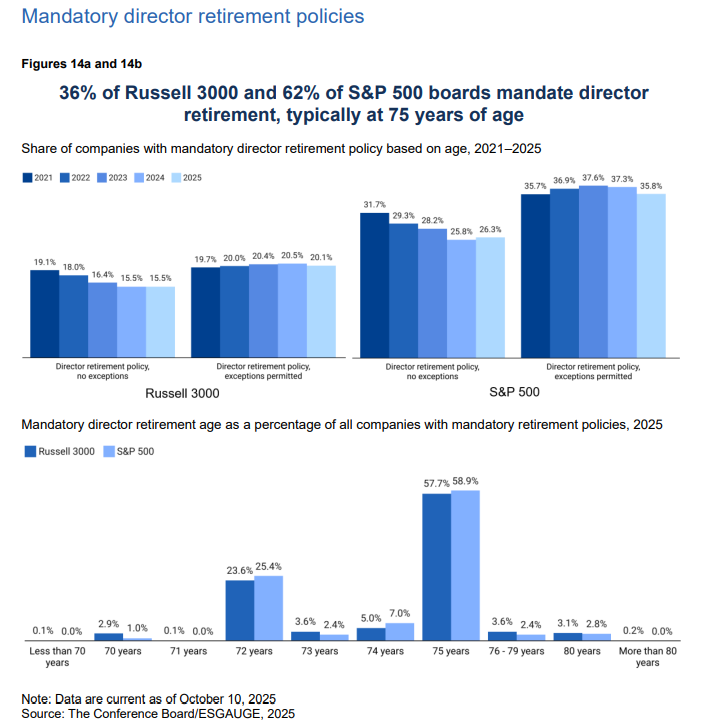

Age-based retirement policies remain far more common than term limits, though their use is declining. From 2021 to 2025, the share of companies with such policies fell from 38.8% to 35.6% in the Russell 3000 and from 67.4% to 62.1% in the S&P 500. The shift suggests boards are increasingly favoring evaluation-based assessments over rigid age thresholds, reflecting both greater appreciation for the experience older directors bring amid complex risk and leadership challenges and recognition that people are living and working longer.

Among firms that do maintain retirement policies, 75 years of age has become the prevailing standard. The once-dominant limit of 72 years old has steadily faded—down from 36.2% to 23.6% of Russell 3000 companies and from 44.3% to 25.4% of S&P 500 companies since 2018—while a small but growing share (around 3%) has extended limits to 80 years of age.

This gradual rise in retirement ages tracks closely with the overall aging of US boards and underscores the premium placed on continuity and accumulated expertise.

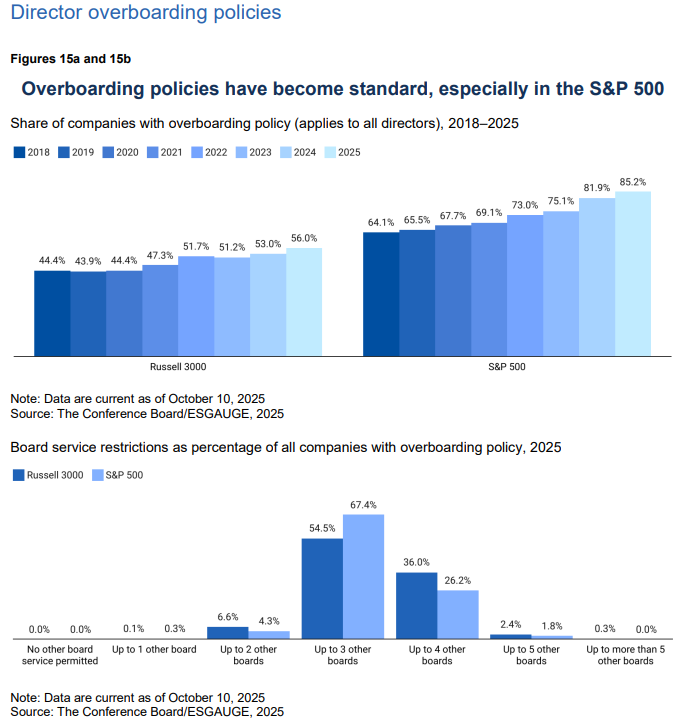

Overboarding policies, which limit the number of public company boards a director may serve on, have become a standard practice across large-cap companies and are increasingly common in the broader market, driven by rising expectations that directors be available, prepared, and crisis ready, as well as scrutiny over potential conflicts of interest. Among companies with limits, the prevailing standard allows service on a total of four public company boards, including the home board. Firms in more regulated sectors—such as financials, utilities, and materials—often adopt stricter caps, reflecting heavier oversight demands.

While such policies provide clarity and reassure investors about director capacity, they also involve trade-offs. Rigid numerical limits can oversimplify effectiveness and exclude qualified candidates with valuable cross-sector experience. Recognizing this, leading investors and proxy advisors increasingly support more nuanced approaches: distinguishing between executives and nonexecutives, applying tighter limits to sitting CEOs and chairs, and emphasizing qualitative factors such as attendance, preparedness, and contribution over fixed thresholds.

Together, these policy trends illustrate how boards are moving away from rigid, rule-based mechanisms for director turnover and toward judgment-based systems that combine flexibility with accountability. The result is a governance model emphasizing oversight capacity, performance evaluation, and investor confidence, rather than prescriptive compliance.

Conclusion

As corporate America looks ahead to 2026, board structures remain strong, but the forces shaping them—political and legal shifts, global regulatory divergence, rapid technological change, new disclosure regimes, and evolving investor expectations—are growing more complex. The 2025 data depict experienced, stable boards that are slower to refresh and, in some areas, less transparent. The challenge now is to preserve that stability while ensuring agility and credibility in a business and governance environment that is often changing faster than the boards that oversee it.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.