US Proxy-Voting Trends: 2025 in Review

Key Observations

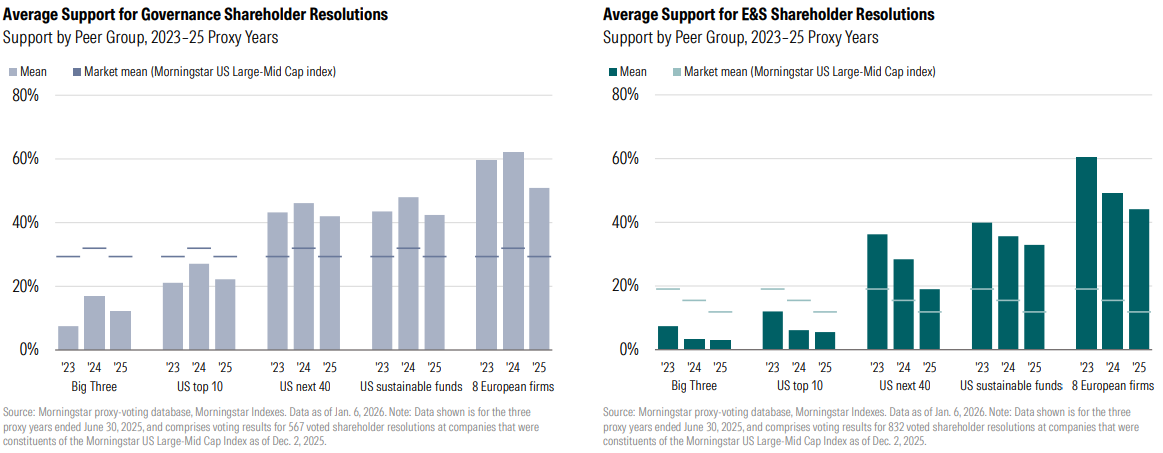

- We analyzed proxy-voting records of 50 of the largest US managers of equity and allocation funds for companies in the Morningstar US Large-Mid Cap Index over the 2023, 2024, and 2025 proxy years. We also assessed votes by eight European asset managers and 601 US sustainable funds.

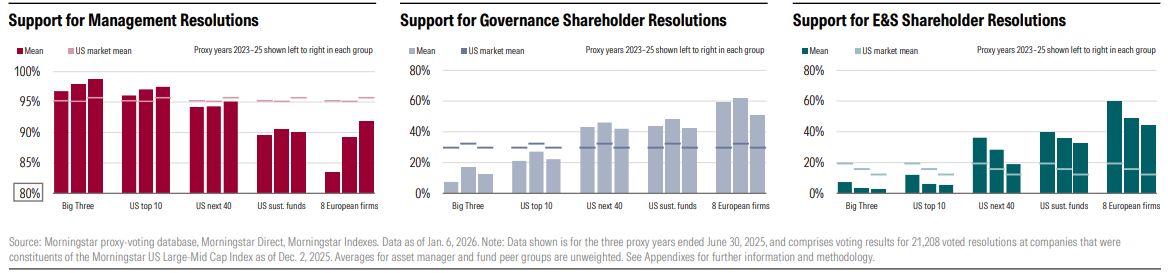

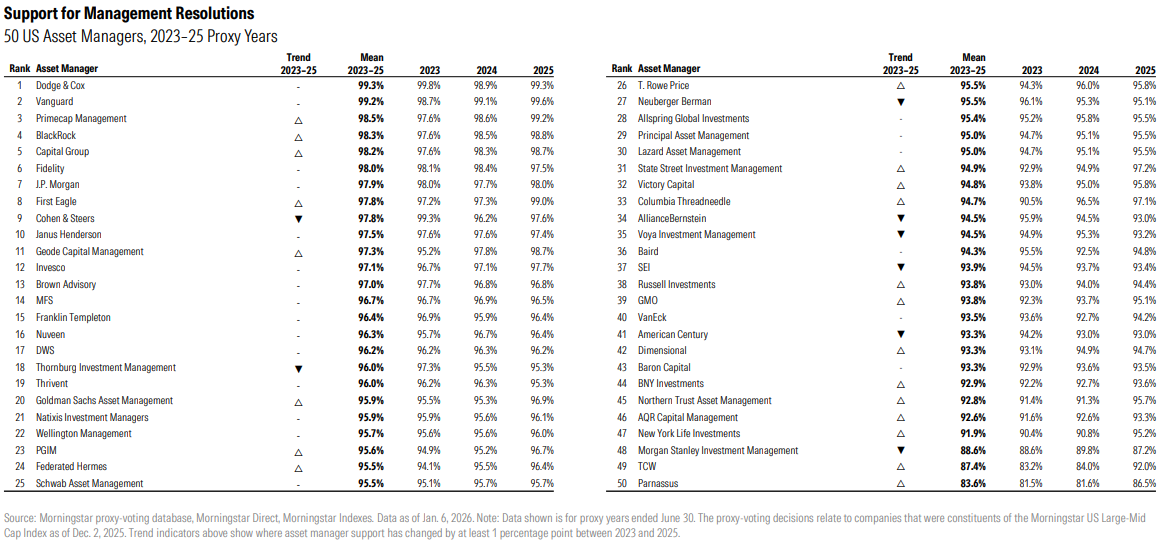

- There was a slight increase in shareholder support for management resolutions: Average support rose to 95.6% in 2025, from 95.0% in 2024 and 95.1% in 2023.

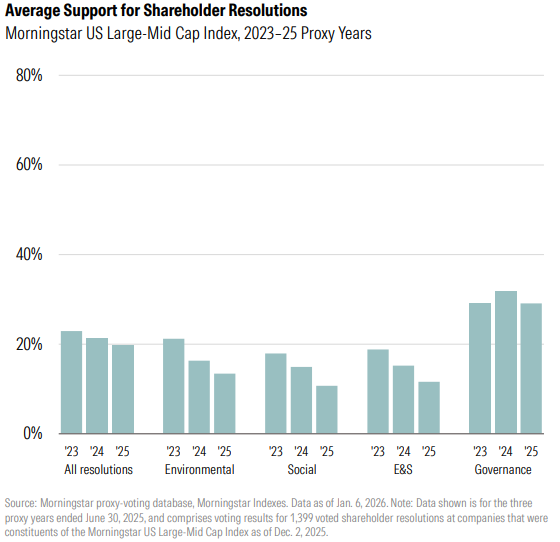

- Average support for shareholder resolutions on governance remained steady at around 30%.

- Meanwhile, average support for environmental and social, or E&S, shareholder resolutions fell from 18.8% in the 2023 proxy year to 11.6% in 2025.

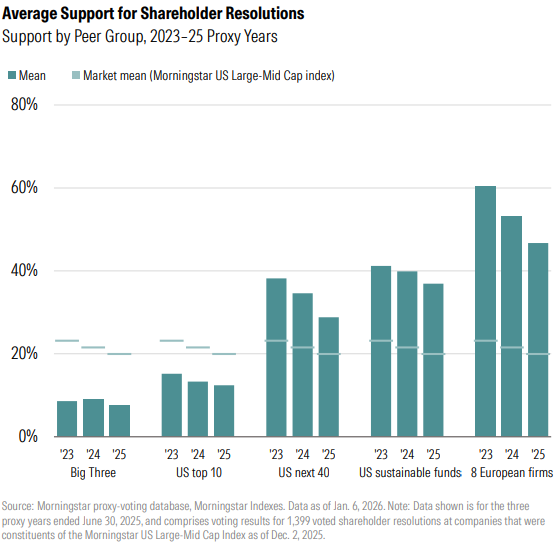

- Votes by the top 10 US managers of equity and allocation fund assets were more supportive of management compared with the other 40 US firms.

- The top 10 comprises the Big Three index managers— BlackRock, State Street, and Vanguard—alongside Capital Group, Dimensional, Fidelity (including funds subadvised by Geode), Invesco, J.P. Morgan, Schwab, and T. Rowe Price.

- These firms showed above-market-average support for management resolutions and below-marketaverage support for shareholder resolutions every year. The reverse is true for the next 40 US firms.

- Voting decisions by US sustainable funds showed much lower support for management resolutions and much higher support for E&S shareholder resolutions compared with the US firms overall.

- European firms dissented from the management view more often than any of the US peer groups, reflecting a transatlantic gap in voting patterns.

Voting Trends: Management Resolutions

Analysis of support for management proposals at Morningstar US Large-Mid Cap Index companies.

Support for Management Resolutions Increased Slightly in 2025

There were several major regulatory and political developments that affected proxyvoting trends in the US in 2025, as both the Securities and Exchange Commission and the White House took actions, affecting this important source of investor feedback to companies over the course of the year.

Asset owners rely on proxy-voting records to assess alignment between their own objectives and the asset managers they appoint. This paper is a comprehensive review of US proxy-voting patterns that can help asset owners make that assessment.

This research paper covers voting records for the 2023, 2024, and 2025 proxy years for companies that were constituents of the Morningstar US Large-Mid Cap Index at the end of 2025. (It is worth noting that shareholder dissent is often higher among smallcap companies than at the large- and mid-cap companies included in this study. However, we believe our analysis of 6.2 million fund voting decisions at over 500 companies representing the top 90% of investable US market capitalization is sufficient to give a reliable indication of key trends.)

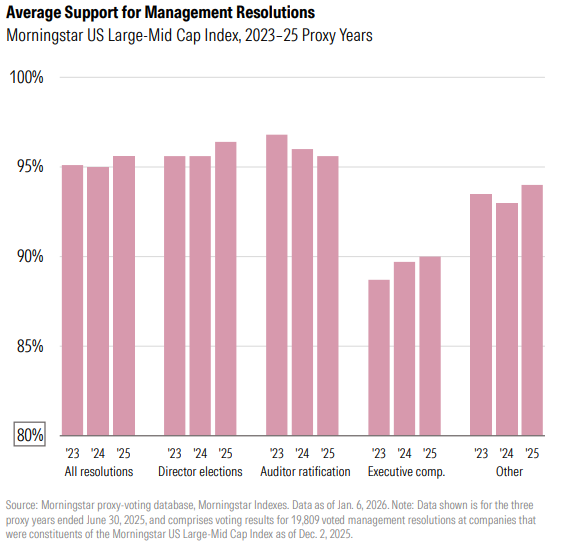

There was a slight increase in average support for management resolutions in the 2025 proxy year (95.6%) compared with the previous two years (2023: 95.1%, 2024: 95.0%). The increase was largely driven by greater support for director elections, which make up around 78% of all management resolutions each year. Advisory votes on executive compensation (which comprise around 8% of all management resolutions) consistently attract around 10% shareholder opposition each year on average. However, there has also been a noticeable improvement in support for these proposals recently.

Marginal Increases in US Asset Managers’ Backing for Management Resolutions

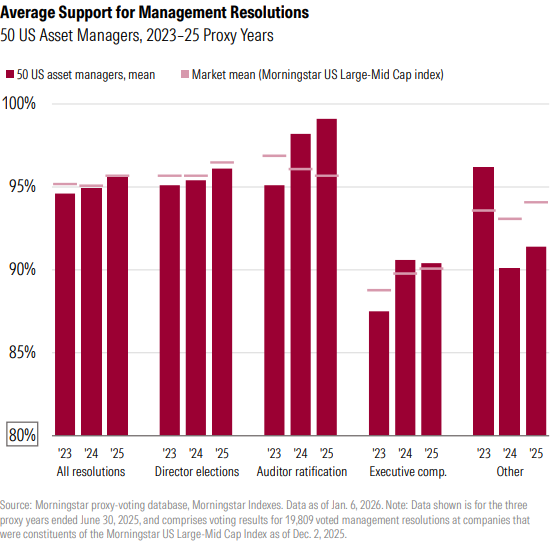

Average support for management resolutions among the 50 US asset managers included in this study closely reflects the market average over the past three years. This is particularly the case for director elections and votes on executive compensation.

The 50 firms’ average support for management resolutions increased to 95.6% in the 2025 proxy year, from 94.9% in 2024 and 94.6% in 2023. Their support for director elections increased in a similar fashion, from 95.1% in the 2023 proxy year to 95.4% in 2024 and 96.1% in 2025.

Average support among the 50 firms for executive compensation proposals stood at 87.5% in the 2023 proxy year—the first year of mandatory annual “say-on-pay” votes at many US companies. However, the firms’ support for these resolutions increased to just above 90% in the subsequent two years.

Resolutions to ratify auditor appointments rarely encounter significant opposition. Still, it is noteworthy that average support by the 50 firms for auditor ratifications increased from 95.1% in the 2023 proxy year to 99.1% in 2025.

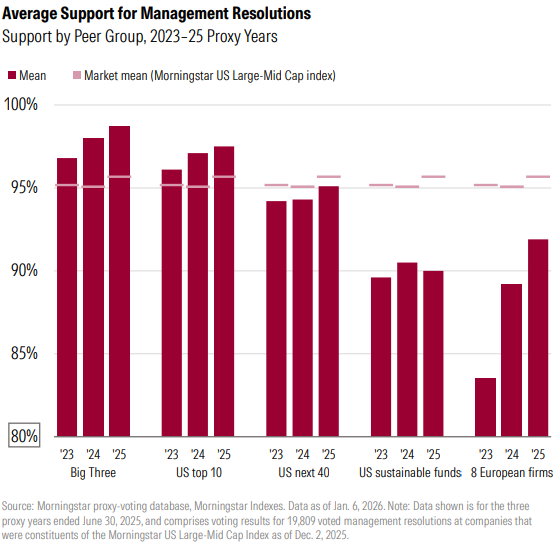

Larger Firms Show Highest Support for Management Resolutions

The chart opposite shows different groups’ support for management resolutions over the past three proxy years. It is noteworthy that the top 10 asset managers’ support for management proposals has been consistently higher than the market average over the past three years and has risen in each year. (The top 10 comprise BlackRock, Capital Group, Dimensional, Fidelity, Invesco, J.P. Morgan, Schwab, State Street, T. Rowe Price, and Vanguard. Fidelity funds subadvised by Geode were also included and separately analyzed.) Average support for management resolutions among the top 10 US managers increased to 97.5% in the 2025 proxy year compared with 97.1% in 2024 and 96.1% in 2023.

Among the Big Three index managers—BlackRock, State Street, and Vanguard—we observed the same trend with higher support levels. On average, the Big Three managers backed 98.7% of management resolutions in the 2025 proxy year, compared with 98.0% in 2024 and 96.0% in 2023. The remaining 40 US managers’ average support stood at around 94% to 95% over the past three years, with a slight increase in 2025. Overall, 21 of the 50 US managers showed an increasing trend in support for management resolutions from 2023 to 2025. Only eight showed a decreasing trend, with the remainder largely stable. (See table overleaf.)

US sustainable funds’ support for management resolutions was consistently around 5 percentage points lower than the market average, at around 90% on average over the past three years. Average support by a comparator group of eight European firms also showed a greater tendency to oppose management resolutions. However, their average support level increased from 83.5% in 2023 to 91.9% in 2025, as their opposition to certain director nominations and executive compensation proposals reduced over time.

50 US Asset Managers: Support for Management Resolutions

Voting Trends: Shareholder Resolutions

Analysis of support for shareholder proposals at Morningstar US Large-Mid Cap Index companies.

Support for Governance and E&S Shareholder Resolutions Diverged

Our September 2025 research paper outlined the marketwide decline in support for shareholder resolutions in 2025 compared with prior years, with proposals on E&S topics faring worse than those addressing corporate governance. So, it is not surprising to see those trends hold true for Morningstar US Large-Mid Cap Index constituents, as shown on the chart on the opposite side.

The number of voted resolutions in the 2025 proxy year fell 27% year on year to 374, after new SEC guidance in February 2025 permitted companies to exclude more shareholder resolutions from the proxy ballot. (In November, the SEC subsequently decided to withdraw from opining on whether shareholder resolutions can be excluded by companies.)

Despite the smaller population of voted shareholder resolutions, average shareholder support in the 2025 proxy year continued a years-long decline. Taken as a whole, average support for shareholder resolutions at companies in the index fell to 19.7% in the 2025 proxy year, compared with 21.3% in 2024 and 22.9% in 2023.

In 2025, average support for governance proposals retreated to their 2023 level (29.1%), after an increase to 31.7% in 2024. Meanwhile, average support for E&S proposals fell to 11.6% in 2025, compared with 15.2% in 2024 and 18.8% in 2023.

Support for Shareholder Resolutions Appears Broader Than the Market Average Suggests

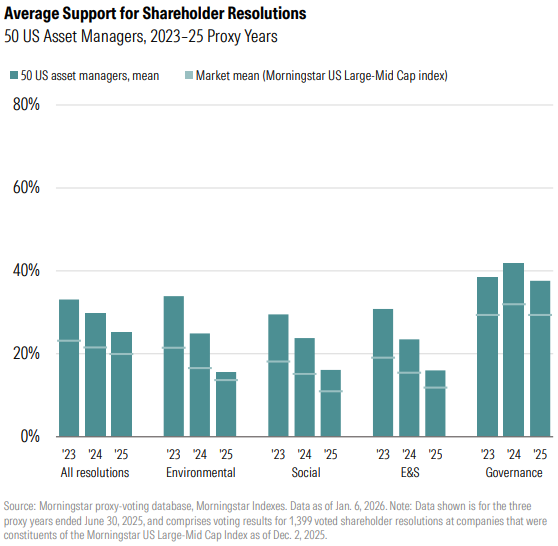

Average support for shareholder resolutions by the 50 US asset managers in this study stands considerably higher than the market average. The fact that the unweighted mean support by the 50 managers exceeds the market mean reflects a lack of support for shareholder resolutions by the largest asset managers who control more of the shares. We further analyze this effect on the following page.

Mean support for shareholder resolutions among the 50 managers stood at 25.2% in the 2025 proxy year, down from 29.9% in 2024 and 33.1% in 2023. Support for governance resolutions by the firms remained relatively stable between 37% and 42% over the past three proxy years. Meanwhile, the 50 firms’ support for shareholder resolutions addressing E&S themes fell to 16.0% in the 2025 proxy year, compared with 23.5% in 2024 and 30.8% in 2023.

Top 10 Asset Managers Led Opposition to Shareholder Resolutions

The chart opposite illustrates that the top 10 US asset managers’ low support for shareholder resolutions—and particularly that of the Big Three—has a dampening effect on market average support levels due to their much larger shareholdings. That said, 27 of the 50 US asset managers in this study showed a declining trend in support for shareholder resolutions over the past three years, with only three on an upward trend. (See table on page 14.)

In the past three proxy years, average percentage support for shareholder resolutions by the Big Three index managers stood in single digits. In 2025, this number stood at 7.5%, having fallen from around 9.0% in the previous two proxy years. We also observed a falling trend in support for the top 10 as a whole. On average, the 10 firms cast 12.4% of their fund votes in support of shareholder proposals in the 2025 proxy year, compared with 13.3% in 2024 and 15.2% in 2025.

The other 40 firms’ average support for shareholder resolutions also displayed a falling trend but stood consistently higher than that of the top 10 over the three-year period. In the 2025 proxy year, the 40 firms’ average support for shareholder resolutions was 28.8% compared with 34.6% in 2024 and 38.2% in 2023.

US sustainable funds also supported a higher-than-average proportion of shareholder resolutions, with a less steep decline in support from 41.2% in 2023 to 36.9% in 2025. The European asset managers we reviewed backed a much higher proportion of shareholder proposals than the US firms, but with a steep decline in average support from 60.3% in the 2023 proxy year to 46.7% in 2025.

We observed similar trends when analyzing governance and E&S shareholder resolutions separately. The various groups of asset managers broadly tracked average support trends in the wider market, showing much higher support for governance proposals than E&S proposals. However, average support by the top 10 US asset managers was considerably below market average, standing in contrast to the other 40 US managers, European firms, and sustainable funds, which all recorded consistent above-market-average support.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.